HOMELEND = A CROWDFUNDING MORTGAGE PLATFORM

What is HOMELEND ?

Homelend is a decentralized platform enabling the next generation of homebuyer mortgage financing. Homelend creates an interface for direct interaction between borrowers, lenders and other parties involved in the mortgage value chain. By doing so, it enables mortgage crowdfunding using a peer-to-peer model with the security, transparency and automation provided by distributed ledger technology (DLT) and smart contracts.

The US mortgage market is worth $ 14 trillion, and the global market is expected to reach $ 31 trillion by the end of 2018. However, regardless of how socially and economically the market is, the traditional mortgage lending system remains very primitive.

This system relies on a long and complex paper-based process involving various intermediaries - a process loaded with inefficiency and overhead for borrowers and lenders. In addition, most mortgage loans are not affordable for a new generation of young borrowers, including millions of credit worthy individuals from getting a home loan because of the outdated assessment criteria.

Crowdfunding Homelend Mortgage Platform

We Developed a Decentralized Mortgage Lending Platform, Peer-To-Peer Serves Two Purposes:

-Modernize old age mortgage loan system to be efficient, cost-effective, and customercentric.

-Expand home ownership opportunities for new generation of borrowers, meet their different lifestyles and needs.

What Homelend Problems Are Search to Solve ?

Homelend sought to use blockchain technology to disrupt the "ancient" mortgage industry. Homelend's whitepaper notes today are a mortgage industry centered both socially and economically, and "traditional mortgage lending systems remain very primitive." Some of the issues identified by Homelend include:

The mortgage process is long, complicated, and requires a lot of documents.

Applying for a mortgage is filled with an intermediary that reduces efficiency and adds cost to the application process.

Mortgages are not affordable for a new generation of young borrowers, meaning millions of credit-worthy individuals can not obtain a home loan "because of the outdated assessment criteria"

How it works ?

By leveraging DLT and smart card technology, Homelend brings together end-users and borrowers on a terminal basis to streamline and automate the whole process. Mortgages.

The HMD Token is the source of energy for the Homelike peer lending platform. Its main function is to grant access to the Homelend platform.

This token also plays an important role in making workflows fast, smoother and user-friendly, consistent and secure.

Features and Benefits Homelend

Efficient: The current mortgage application process is manual and long. Homelend wants to use blockchain and smart contracts to make it efficient and efficient. Homelend will embed its predefined business logic into smart contracts, digitize documentation and eliminate unnecessary processes. Homelend specifically aims to bypass the mortgage origination process from start to finish from 50 days to less than 20.

Transparent and User-Friendly: Homelend strives to get rid of today's ambiguous and clumsy mortgage application process and replace it with a transparent and user-friendly process. Homelend will create a smart, simple, and fair lending process, allowing borrowers to easily apply for loans, track the status of their applications at any time, and interact directly with mortgage lenders.

Cost-Effective Without Intermediaries: Homelend will introduce a cost-effective mortgage application process that is free from intermediaries. Blockchain will replace the intermediary, providing a way for two parties to distrust each other to interact with each other. All transaction data will be recorded in blockchain, allowing borrowers and lenders to maintain maximum transparency during the transaction process.

Trusted and Safe: Homelend aims to use blockchain to process mortgage-related data in a more reliable, transparent, and secure way than ever before.

HMD Token

HMD tokens will be used to purchase services and pay fees in the Homelend platform. This token is based on the ERC-20 Ethereum standard. DMC Homelend AG was founded in Zug, Switzerland, aka 'Crypto Valley'. Initial Coin Offering (ICO) will be conducted based on Swiss regulatory guidelines and publications.

The purchase of ICO Homelend pre-sale is in progress!

Token Symbol: HMD

Initial Date Before ICO: March 1, 2018

Pre-ICO Conversion: 1 ETH = 1600 HMD

Hard Cap: $ 30 million USD

Total Supply: 250 million HMD tokens

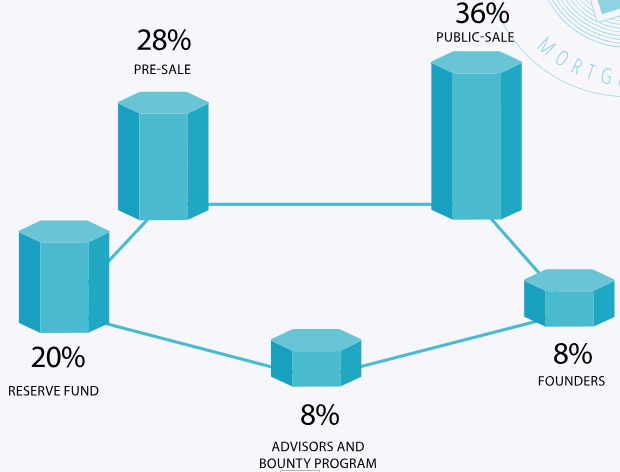

Supply Distribution

36% Crowdsale

20% For teams, initial buyers and project advisors.

8% Advisor + Bounty rewards

8% Founder

Bonus ( ETH / HMD )

Week 1 : 20%

Week 2 : 15%

Week 3 : 10%

Week 4 and After : 0%

ROADMAP

FURTHER INFORMATION

Whitepaper : https://homelend.io/files/Whitepaper.pdf

Facebook : https://www.facebook.com/HMDHomelend/

Twitter : https://twitter.com/HomelendHMD

Telegram : https://t.me/HomelendPlatform

Reddit : https://www.reddit.com/r/Homelend/

My profile:https://bitcointalk.org/index.php?action=profile;u=1965191

Comments

Post a Comment