CEYRON: The first crypto platform investment debit card

What is CEYRON ?

Ceyron is a decentralized exchange system that seeks to improve the liquidity of cryptographic assets more transparent and secure than the core counterparts currently in the market. Ceyron is an ecosystem built and operated by a network of popular partners around the world in a centralized network. The goal is to provide a globally appropriate financial experience with the power of Blockchain technology. Ceyron has a simple and sustainable transaction-based business model. Every trader benefits from the transaction.

The advancement of the financial and blockchain industry has now become doubtful. For that required token that can combine both. Ceyron Finance Ltd (hereafter “CFL”), intends to bring together financial industry expertise and revolutionary blockchain technology. CFL is disrupting two divergent worlds: Cryptocurrency, and Financial services.

becomes cryptocurrency based on platform investment with cryptocurrency trading terminal, debit card and chip capabilities offer safely supported credit assets.

ceyron becomes cryptocurrency based on platform investment with cryptocurrency trading terminal, debit card and chip capabilities offer safely supported credit assets.

Investment Objective and Strategy

The Fund’s investment objective is to provide attractive returns on invested capital through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd. The Fund will adhere to an investment strategy driven by data science, in which machine learning within fully non-parametric statistical models are applied to the problem of expected gains in financial investments.

The net income earned by the Fund during any given month shall generally be retained for reinvestment, but a portion of potential periodic earnings may be used for distributing annually dividends to CEY Token holders, where such dividends are approved by CFL’s board and voting shareholders.

Credit Portfolio Backed Token To Provide Less Volatility and More Cash Flow

The portfolio of credit assets will further be secured by a surety wrap to enhance stability and returns. The Fund Manager will use artificial intelligence and machine learning to build a portfolio of secured credit assets.

Blockchain Technology Enables Efficient Liquidity for Investors

Blockchain technology has the potential to provide greater integrity, safety, security, and transparency. As such, CFL will use the blockchain to ensure immediate transaction adjudication at low costs in hopes of providing greater liquidity for investors.

Efficient Prepaid Debit Cards

The account holders will be empowered to select from multiple cryptocurrencies for use as tender, and when they initiate a transaction (e.g. a dinner that costs $83.65), either prepaid debit cash will be used, or the holder can elect to use a supported cryptocurrency, which will then be sold at spot price to complete the transaction.

Competitive Fees

Since CFL will hold both cash and an array of cryptocurrencies at all times, it will be able to facilitate seamless exchange of cash in cryptocurrency to facilitate transactions, and will enable CFL to compete with Coinbase on both service and fees.

CFL is Launching into a Growing Market

The market for cryptocurrencies has grown by more than one hundred and sixty billion USD ($160,000,000,000) in the last year. Financial giants and Central Banks alike have invested in blockchain technology. Both large and small investors seek a more regulated market that allows for the safety nets and insurance coverage offered in any registered security market.

The problem Ceyron wants to solve is summarized below.

Banks are increasingly adopting mobile banking to:

- develop online banking services.

- take digital advantage for those who integrate millions of people into the formal financial sector.

- develop merchant payment services.

Low Bank Rate The

economy of Africa is highly liquidated and has a very bad financial footprint. Less than 10% of adults have bank accounts. The market returns with cash transactions. For example, more than 85% of trade is cash.

A highly competitive market

The mobile money environment in Africa is increasingly competitive. This increased competition means that consumers have more choices.

Very Low Usage Rates

In the world, 12% of account holders are in Africa. However, the level of inclusion in the financial system is very low. The behavioral analysis of the average paying user is similar to the general trend: the payment is equal to at least 60% of the transaction volume; Peer-to-peer transactions 20%; 10% call duration, 8% payment and 2% savings.

CFL solutions

Credit Portfolio Fund CFLs, Colombus Investment Management Ltd. 's main Asset is an asset that is not obtained from the credit bank. Assets, mortgages, second mortgages, bridging loans, real estate loans, car loans and equipment leases, commercial real estate loans, loans and asset based factoring consists of contracts. Non-bank financial institutions providing credit and, in General, retain all skills services. The Fund will, from time to time, obtain a loan in the form of separate loans in the pool, or in the interest of equity in loans. Billing and collection functions are usually creative for the recipient claims credit as payment of a nominal fee and in the case of bonds will continue to be the main provider of the transfer of resources, including a loan fulfillment of obligations special services so far to provide and pay in full. The credit function in addition to the services provided by the creator, a person does not comply with or over creative duties, an officer's "backup " secondary involved. This ensures that cash deposits and repayment of the credit assets continue. Today, 60 percent of mortgage loans in the U.S. held by banks to 30 percent (30 percent) in the year 2013. It was held on a platform of bank loans by hundreds of us banks $ trillion mortgage only on us. Investment Manager platform to connect with debt repayment and risk and the origin of the existence of a credit profile, origin, volume, duration and cost of the warranty, regulatory compliance is responsible for quality management and to the definition of quality of service to confirm. Investment managers, the highest-performing assets available on the platform, will be assigned to liquidate a portfolio of high-risk assets for the CFL from either voters or the portfolio of CFL. Solution of the Jeyran brought here

-Easy access to 20 dollar currencies + supported crypto conversions via CEY card (physical, virtual and debit MasterCard with mobile application for convenience) with competitive prices compared to the current international debit card.

-Annual dividends (possibly not guaranteed): from part of the potential periodic income received by the Fund - from their financial investments, to be precise.

-And last but not least: a high value token - a CEY token - with a stable and highly profitable portfolio of loan assets

with a high degree of integrity, security,anonymity and transparency in a highly efficient decentralized system, thanks to all the changing technologies in the world: artificial intelligence, computer training and, of course, a block chain.

The CEY Card is a physical, virtual and paid MasterCard card with a mobile application that lets you use twenty (20) foreign currency from a single card. In similar lifestyle card markets, most cards charge a percentage of the market price of a foreign currency distribution in addition to transaction costs. Customers traveling with more than one currency to more than one country will surely have to enter the Cash Exchange Fee and the Cost of a Currency Transaction. This cost is largely a process plus flat rate, the sector's main wage is 2.75% - 2.99%.

Sales and Distribution Token Ceyron

- Token Name: Ceyron

- Symbol Token: Cey

- Price: 1.00 USD per Cey Token

- Number of tokens for sale: 250 000 000

- Pre-Token Sales: 16/02/18

- Sale of Pre-Token: 15/03/18

- Pre-sale tariff discount: 30%, 25%, 15%

- Token sale starting: 16/03/18

- Soft Cap: TBA

- Hard Cap: TBA

- Home campaign: TBA

Final sale Token:

- Currency Received: BTC, ETH, LTC and USD

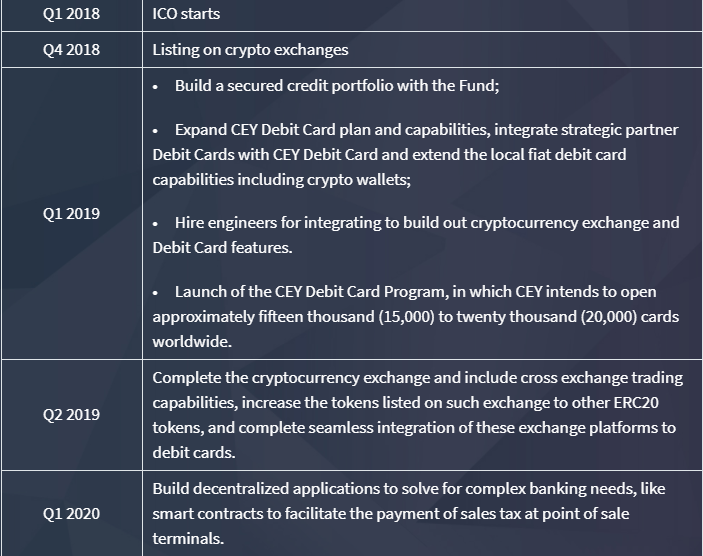

ROADMAP

FURTHER INFORMATION

Whitepaper: https://ceyron.io/wp-content/uploads/2018/02/white-paper-ıco-cey-token-updated31012018.pdf

Telegram: https://t.me/joinchat/HlFuxhLIUYQL88_NtoM4sA

Facebook: https://www.facebook.com/Ceyron /

Twitter: https://twitter.com/cryronico

My profile:https://bitcointalk.org/index.php?action=profile;u=1965191

Comments

Post a Comment